One factor is crucial in finding the right candidate: time! Time is money. This also applies to recruiting vacant positions. But what is hiding behind the metric time to hire? Are you aware that the success of a business can depend solely on this metric?

In this article, we'll illustrate how important time to hire is for the entire organization through four examples. In addition, we'll provide you with valid arguments and figures for your next internal discussion that will make analyzing time to hire a priority.

To understand all the other consequences associated with the concept of time to hire, it is important to first discuss the definition of this KPI.

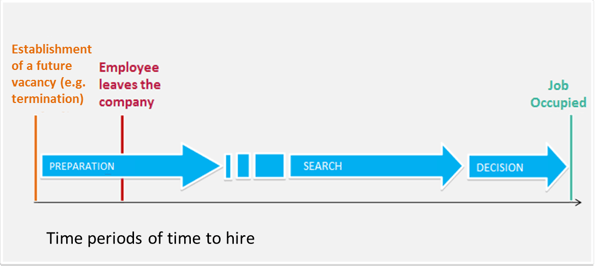

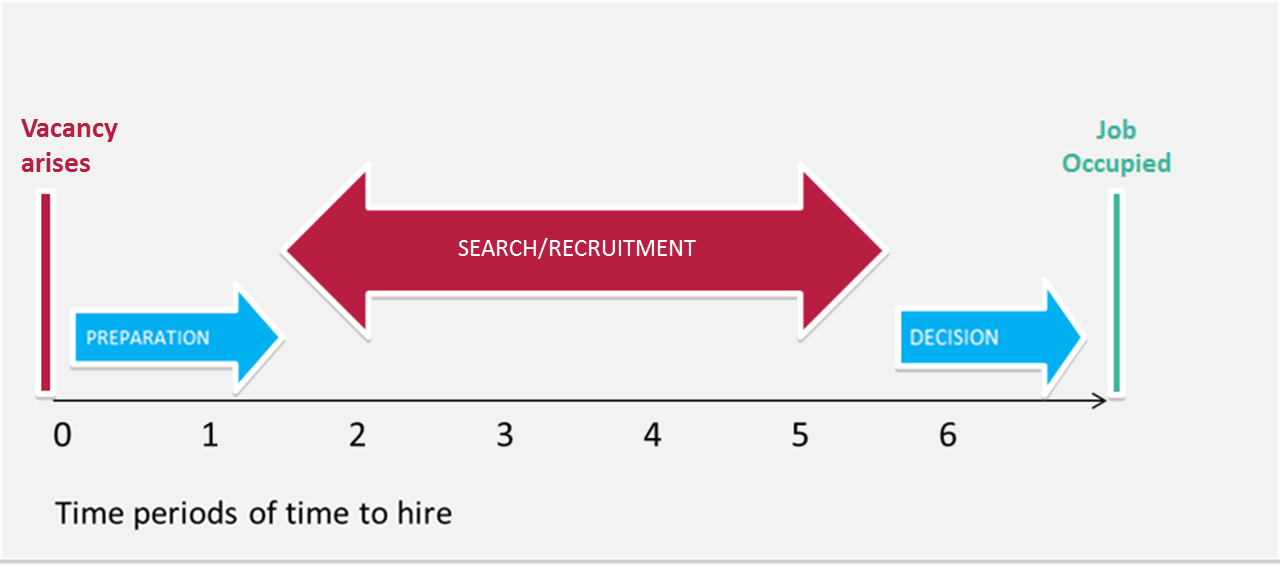

The term "time to hire" is not clearly defined in literature. Companies usually speak of the duration of the employment search as a key figure. However, this only describes the period between the beginning of the recruitment search and the end of the recruiting process. In reality time to hire covers a much larger period. It does not start with recruiting, but much earlier: from the day it is clear that an employee will be leaving the company until the job is filled by a new employee. Time to hire can be divided into different phases: preparation phase, personnel search phase and decision phase.

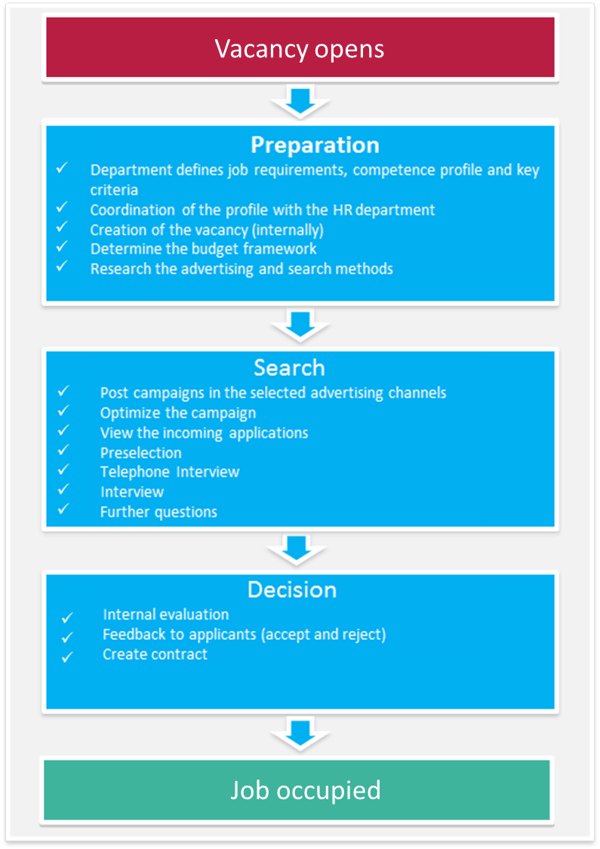

The following graphic shows which processes run in each individual phase:

Fig .: Phases of time to hire as already mentioned in the first section. It is important to be aware of the costs that arise at this time for the recruiting department or for the whole company.

Time to hire consists of two major cost catagories:

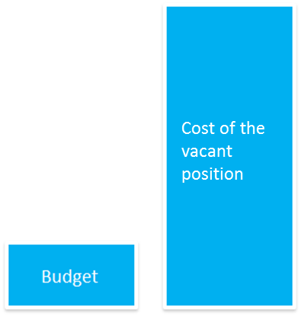

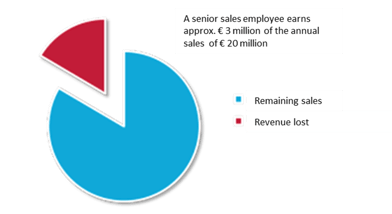

Most companies only consider the external budget, which is set for the search and recruitment process. However, this is insufficient, because the resulting opportunity costs (= lost benefits, such as sales losses) as a result of the vacant position are many times higher! The budget is a barely noticeable cost factor compared to the cost of an unoccupied job. The breakdown of revenue losses by vacancy compared to budget costs breaks down as follows:

Fig .: Recruiting budget compared to the costs of an unoccupied position. Companies incur enormous costs due to vacant positions, particularly with key positions and management functions, because further positions depend on the vacant position or the entire production is affected. Depending on the location, the consequences are clearly noticeable such as loss of sales, production restrictions and loss of innovation. If recruiting fails during this period and the time to hire period grows larger, in the worst case, it can even lead to a financial bankruptcy of a company. In order to make the costs more tangible during recruitment, we used data from the study "Business Effects of Family-Friendly Measures" by the German Federal Ministry for Family Affairs, Senior Citizens, Women and Youth. In the study, business effects regarding the cost of the replacement of personnel were evaluated on the basis of controlling data from ten companies of different sizes and sectors. The study defines the costs for companies when looking for a new employee as follows:

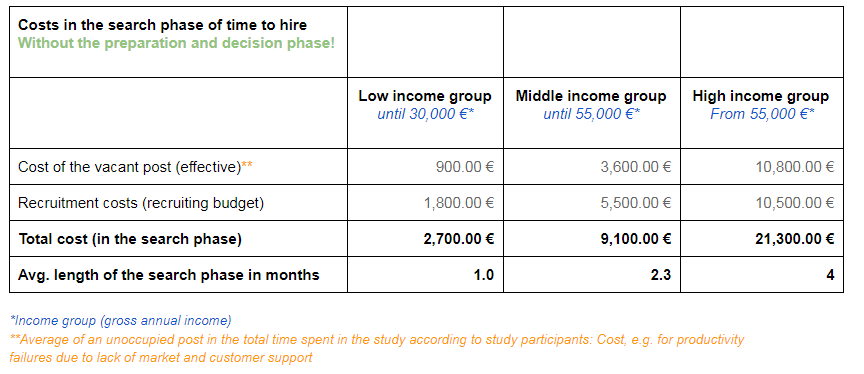

The calculation of the cost of a vacant position for different ranges of income in the companies surveyed gave the following average values:

These costs are highly dependent on the required qualification level of the requested person and the specificity of the quality requirements. External factors include the closeness of specific labor markets and the shortage of qualified personnel leading to a singular increase in recruitment costs. For the average duration from the start of the search to the recruitment, the participating companies give the following average values: → Lower income group: 1 month → Middle income group: 2.3 months → Upper income group: 4 months

The lower income group includes, for example, a "hairdresser". The search period of one month is a realistic value in relation to the degree of qualification and the demand on the job market. The middle income group includes, for example, young graduates. In our experience, two ads with a minimum of 30 days each have to be shown in order to reach this group. As a result, at least 2.3 months should be scheduled for the search phase alone. The upper income group is largely specialized staff with many years of experience. This group of professionals and senior professionals is considered to be particularly difficult to a recruiter as it places high demands on their job and employer and is difficult to achieve due to passive search behavior. For this reason, the search periods are much larger. Caution should be exercised with these values: In general, it should be recognized that only the search and recruitment phase have been taken into account and not the preparation phase and the decision phase. The actual time to hire is so much longer in this case and the costs are therefore higher than the above average values. Therefore, an even longer search phase (pure advertising phase) can be expected today.

Fig .: Time to hire periods in the case of a vacant position in the higher income group. To illustrate the effects of time to hire and the associated costs, here are four examples. Maybe you already have similar experiences or have such vacant positions in your company:

A vacant position in the field of "sales" hits a company particularly hard, because this department is mainly responsible for the entire company turnover and even the loss of a single person has a strong impact on sales. If a key position is not filled here, this can mean a loss of sales of 300,000 euros per month for a company and at least 1,210,500 euros during the recruitment period!

An example of this calculation: a senior sales representative in mechanical engineering. A company in the mechanical engineering sector with ten sales employees generates 20 million euros annually in sales. The sales team is divided into three senior sales people, who provide 50% of total sales, the other seven together generate the rest of the turnover. Our ratio assumed that the best senior salesperson with 4 million euros in annual sales is outstanding. This means a monthly loss of 300,000 euros for the entire company! In addition, there is a gain (increase in value) of € 75,000, which is lost to the company every month. The fixed costs of the company remain unchanged (personnel salaries, room rents, depreciation, etc.).

If you start from the above mentioned search phase of at least 4 months (according to experience, however, it is often 6 months), then the following costs arise:

Vacancy: 4 x 300,000 € = 1,200,000 €

Recruitment costs: 1 x 10,500 € = 10,500 €

---------------------------

Costs during the recruiting period: 1,210,500 € (plus loss of income during this period)

This clearly shows the extent to which a single employee in a key position can already have an impact on the company's total revenue and which cost development leads to increasing time to hire.

In many companies, it is specialized positions that are the most difficult to fill. It is particularly serious for a company if the position of the production manager remains vacant for a long time. This can affect up to a loss of revenue of 830,000 euros per month! During the recruitment period these costs amount to at least 3.3 million Euros!

A calculation example: a production manager in the cable industry. A company in the cable industry employs 100 people and generates annual sales of 10 million euros. The production manager with 20 years of professional experience is the only engineer in the company responsible for cable production and product innovation to keep them competitive in the marketplace. If this position is unoccupied, it can come to a complete stoppage of production. That will result in a loss of 20,800 euros per day! Each company has daily fixed costs that always remain the same and can not be changed quickly (for example, salaries, production and manufacturing costs, etc.), and materials that are not quickly changed due to supplier contracts. Over a longer period of time, such a loss of production can ruin a small business by no longer being able to offset the ongoing costs with the sales generated! If you now start from the above search phase of at least 4 months (according to experience, there are usually 6 months), then the following costs occur:

Vacancy: 4 x 830,000 € = 3,320,000 €

Recruitment costs: 1 x 10,500 € = 10,500 €

---------------------------

Costs during the recruiting period: 3,330,500 €

In health care, it is the position of the specialist, a highly specialized position with certain qualifications, which is very difficult to fill and often with a long time-to-hire. In an unoccupied place can be expected here with a pure yield loss of up to 33,000 euros per month! During the recruiting period these costs are at least 142,500 Euro!

An example of calculation: a medical specialist / radiologist. According to the Federal Statistical Office, the net income of a practicing medical specialist, such as the radiologist, is € 402,000 per year. The statisticians describe the revenue that a doctor has left after deducting all costs for the doctor's practice; these include personnel costs, rent, laboratory expenses, diagnostic equipment, etc. We have found that bottlenecks occur particularly in hospitals when occupying specialist positions for certain departments. Assuming that this example of failure of the specialist or radiologist calculates with the above figures, then a single unoccupied specialist office leads to a loss of income around 1,608 euros daily. In addition, there are the ongoing fixed costs for premises, staff, etc. as well as the search / recruitment costs as a recruiting budget, which, according to the study by the Federal Ministry, again amounts to at least € 14,400 per month. In addition, it can always be seen in the big picture that as soon as a specialist in a department is missing, the entire productivity of the latter also suffers. In the case of "hospital", this also has consequences for the external perception. A bad reputation as a "hospital without competent specialist staff" leads to fewer patients, which is directly reflected in the revenue. If one now assumes the above-mentioned search phase of at least 4 months (according to experience it is 6 months), then the following costs arise:

Vacancy: 4x € 33,000 = € 132,000 (lost revenue)

Recruitment costs: 1x 10,500 € = 10,500 €

------------------------------

Costs during the recruiting period: 142,500 €

Finally, let us give an example from our own experience: the vacant position of a "store manager", as an important key position in retail. Alone the lack of a branch management can make a loss of sales of 21,700 euros per month! During the recruitment period these costs are at least 97,300 Euro!

An example of calculation: a branch manager at a sporting goods manufacturer (retail). A sporting goods manufacturer employs 2,160 people and generates annual sales of 180 million euros in its 130 branches throughout Germany. Each individual branch generates a turnover share of 1,380,000 euros per year. In the retail sector, the store manager is a key position when it comes to the overall sales ratio. If the job is not filled, this leads to a loss of revenue by 20%, i.e. 260,000 euros per year. And, in addition, the search and recruitment costs. If one now assumes the above-mentioned search phase of at least 4 months (according to experience, it is 6 months), then the following costs arise:

Vacancy: 4x 21,700 € = 86,800 €

Recruitment costs: 1x 10,500 € = 10,500 €

---------------------------

Costs during the recruiting period: 97.300 €

The above examples make it clear once again what impact time to hire has on a company's costs and losses. A reduction of this period is money that remains in the company and can be used for economic growth and competitiveness. Employees are the most important resource in the company and key positions that can not be filled quickly lead to serious and economically measurable losses. For small companies, an unoccupied key position over a longer period of time can even lead to financial bankruptcy if the fixed costs can no longer be met due to the decline in sales. These examples illustrate the importance of reducing the time to hire and the valuable economic contribution that the recruiting department can make to the entire organization with optimization in this area.

An efficient way to reduce time-to-hire is to increase the number of prospects your business has in your talent network and to build strong relationships with them. Through the targeted establishment of a candidate database, vacancies can be filled quickly and efficiently by recruiting directly from this pool of interested parties.

Check out our page "The Ultimate Guide to Recruitment Analytics and KPIs" to find further resources on the topic of recruitment analytics and KPIs.

These Stories on Employer branding

No Comments Yet

Let us know what you think